Backtesting is the process of testing a trading strategy using historical data to simulate how it would have performed in the past. By using backtesting to develop and refine a cryptocurrency trading strategy, traders can increase their chances of success and profitability in the highly volatile and dynamic crypto market.

What exchanges does backtesting work on?

The backtesting addon works on these exchanges:

Backtesting may work on other exchanges as well. However, since we have only tested these exchanges, we cannot guarantee that it will work on others.

Workaround: If backtesting doesn’t work on your exchange, it is still possible through this workaround: you can use the workaround of connecting to another (supported) exchange without API keys, adding the coin, copying the strategy onto it and then backtesting through it or you can use already saved OHLCV data from other exchanges. However, pay attention to the saved timeframe.

Why use Backtesting?

- Reduce risk: Backtesting allows traders to test their strategies on historical data and identify potential weaknesses or flaws before risking real money in the market.

- Improve accuracy: By analyzing past market data, traders can improve the accuracy of their strategies and make better-informed decisions when trading.

- Optimize parameters: Backtesting enables traders to fine-tune their strategies by testing different parameters and evaluating their impact on performance.

- Save time: Backtesting can save traders time by allowing them to test and refine their strategies, without the need to monitor the market in real-time.

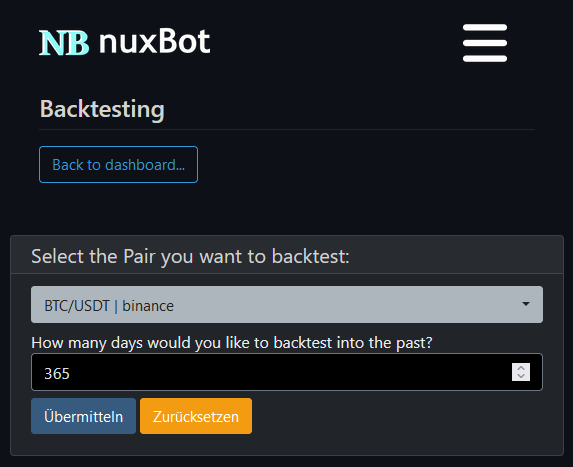

How to use Backtesting in nuxBot?

- Ensure that your License Key has access to Backtesting. If not, you can easily acquire it here.

- Go to your nuxBot Dashboard -> Three horizontal lines in the top right corner -> Settings -> Trading Settings -> Backtesting.

- On this page, you can select your trading pair and how many days you want to backtest.

The duration of the backtesting process can vary depending on the timeframe and the number of days selected. For example, a backtest of 500 days with a 30-minute timeframe should take no more than 2 minutes.

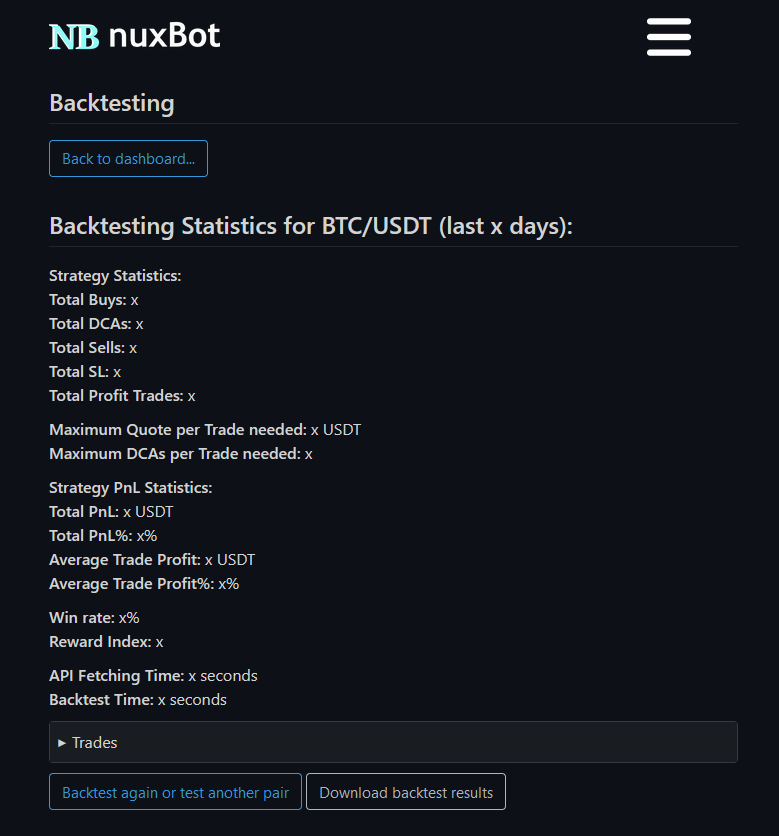

What do the outputs mean?

- Total Buys: The number of buy trades made by the bot during the backtest period.

- Total DCAs: The number of Dollar Cost Averaging (DCA) trades made by the bot during the backtest period.

- Total Sells: The number of sell trades made by the bot during the backtest period.

- Total SL: The number of stop-loss trades made by the bot during the backtest period.

- Total Profit Trades: The number of profitable trades made by the bot during the backtest period.

- Maximum Quote per Trade needed: The maximum amount of quote currency needed for a trade during the backtest period.

- Maximum DCAs per Trade needed: The maximum number of Dollar Cost Averaging trades needed for a trade during the backtest period.

- Total PnL: The total profit and loss in quote currency made by the bot during the backtest period.

- Total PnL%: The percentage of profit and loss made by the bot during the backtest period.

- Average Trade Profit: The average profit per trade in quote currency made by the bot during the backtest period.

- Average Trade Profit%: The average percentage of profit per trade made by the bot during the backtest period.

- Win rate: The percentage of profitable trades made by the bot during the backtest period.

- Reward Index: A measure of the profitability of the strategy. A value above 1 indicates profitability, with higher values indicating greater profitability. A value below 1 indicates unprofitability.

- API Fetching Time: The time it took to retrieve data from the exchange’s API.

- Backtest Time: The time it took to run the backtest (without API Fetching Time).

The outputs are also saved to the pair under “saves/charts/pair/backtesting”, including the backtested trades and a copy of the strategy that was backtested.

Please note that while backtesting can provide valuable insights and help improve trading strategies, it cannot guarantee future success.